Provaris Energy secures $3 million facility from Macquarie launches $2 million share purchase plan

Provaris Energy Ltd has taken strategic steps to secure funding for its hydrogen development plans in 2024/25, aiming to accelerate its initiatives in the evolving hydrogen market. The company has successfully arranged a two-year A$3 million convertible note facility with Macquarie Bank Ltd, providing standby capital to support its ongoing projects. This facility offers Provaris the flexibility needed to pursue its capital-raising activities alongside the advancement of its hydrogen development projects and the commercialisation of its intellectual property and hydrogen supply chain solutions.

Under the convertible note facility, Provaris has the option to access up to A$3 million of standby capital over the next two years. The initial tranche of A$500,000 convertible bond has already been executed, with further tranches to be issued at the discretion of Provaris and Macquarie, ensuring alignment with the company’s evolving financial needs. Each convertible bond will convert into ordinary shares of the company, with the conversion rate determined by the share price at the time of conversion.

Martin Carolan, Provaris managing director and CEO, emphasised the significance of this facility in enhancing the company’s financial flexibility and supporting its development programme funding requirements. He highlighted the strategic alignment between the convertible note facility and the recently announced share purchase plan (SPP) offer to eligible shareholders, further strengthening Provaris’ financial position.

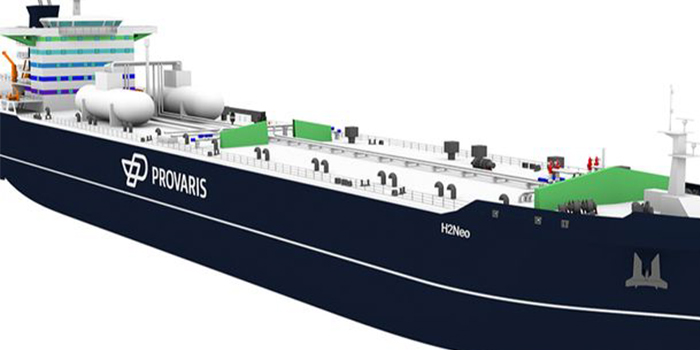

In conjunction with the convertible note facility, Provaris has launched an SPP to eligible shareholders, aiming to raise up to A$2 million (before costs). The SPP allows shareholders to apply for new Provaris shares at a discounted price of A$0.04 per share, without incurring brokerage or transaction costs. The funds raised through the SPP will be directed towards the ongoing development of Provaris’ proprietary IP and solutions for hydrogen storage and marine transportation, as well as supporting hydrogen production and export project development opportunities.

Carolan expressed gratitude to the shareholders for their continued support and highlighted the company’s commitment to delivering a hydrogen supply chain for Europe. He underscored Provaris’ unique approach and first-mover status in the hydrogen market, emphasising the company’s efforts to minimise shareholder dilution while securing necessary funding for its development programme.

Overall, the convertible note facility and the SPP offer represent complementary fundraising initiatives aimed at providing Provaris with the financial resources and flexibility needed to advance its hydrogen projects and capitalise on emerging opportunities in the hydrogen sector.

For more information visit www.provaris.energy

3 May 2024